Retiring comfortably for 20 years could require between $800,000 and $1.6 million, according to ChatGPT, OpenAI’s artificial intelligence chatbot. This range, however, is highly dependent on individual spending habits, lifestyle preferences, and investment strategies, highlighting the importance of personalized financial planning.

ChatGPT’s estimation underscores the significant savings needed to maintain a desired lifestyle throughout retirement. The AI provided this estimate when asked how much money would be needed to retire for 20 years. However, financial experts caution against relying solely on AI-generated figures, emphasizing the need for comprehensive financial planning that considers individual circumstances.

The AI based its calculation on several assumptions, including an annual spending range of $40,000 to $80,000, covering basic living expenses, healthcare, and leisure activities. The estimation also considered a moderate investment strategy with an average annual return and an inflation rate of 2-3%. It’s crucial to note that these are generalized assumptions and may not accurately reflect everyone’s situation.

“Retirement planning is a deeply personal endeavor,” says certified financial planner Sophia Miller. “While AI tools can provide ballpark figures, they should not replace the expertise of a qualified financial advisor who can assess individual needs, risk tolerance, and financial goals.”

Understanding the Nuances of ChatGPT’s Retirement Estimate

ChatGPT’s calculation, while potentially helpful as a starting point, simplifies a complex financial equation. It’s essential to dissect the assumptions made and understand their limitations:

-

Spending Habits: The AI assumes an annual spending range of $40,000 to $80,000. This may be insufficient for individuals accustomed to a higher standard of living or those residing in expensive metropolitan areas. Conversely, those with minimalist lifestyles or living in areas with a lower cost of living may require less. A detailed assessment of current spending habits and anticipated changes in retirement is crucial.

-

Investment Strategy: The chatbot assumes a moderate investment strategy. However, risk tolerance plays a significant role in investment decisions. A more aggressive strategy could potentially yield higher returns but also carries greater risk. A conservative approach may offer more stability but could result in lower growth. Determining the appropriate risk level is paramount.

-

Inflation Rate: An inflation rate of 2-3% is factored into the estimate. Inflation erodes the purchasing power of savings over time. While the historical average inflation rate hovers around this range, it can fluctuate significantly depending on economic conditions. Unexpected spikes in inflation could deplete savings faster than anticipated.

-

Healthcare Costs: The estimate includes healthcare expenses, but these costs can vary widely depending on health status, insurance coverage, and access to medical care. Healthcare costs tend to increase with age, making it essential to factor in potential future expenses.

-

Taxes: The AI’s calculation may not fully account for the impact of taxes on retirement income. Retirement income is often subject to federal and state taxes, which can significantly reduce the amount available for spending. Tax planning is an integral part of retirement preparation.

Beyond the Numbers: Qualitative Factors in Retirement Planning

Retirement planning extends beyond simply accumulating a target dollar amount. Qualitative factors, such as lifestyle preferences, desired activities, and legacy goals, also play a crucial role:

-

Lifestyle Preferences: Some individuals envision a retirement filled with travel, hobbies, and social activities, while others prefer a more relaxed and low-key lifestyle. These preferences directly impact spending needs and, consequently, the amount of savings required.

-

Location: The cost of living varies significantly across different geographic locations. Retiring in a major city is generally more expensive than retiring in a rural area. Relocating to a lower-cost area can significantly reduce retirement expenses.

-

Legacy Goals: Some individuals wish to leave a financial legacy for their heirs or contribute to charitable causes. These goals necessitate additional savings and careful estate planning.

-

Part-Time Work: Many retirees choose to work part-time to supplement their income, stay active, and maintain social connections. This can significantly reduce the amount of savings needed to fund retirement.

-

Unexpected Expenses: Life is unpredictable, and unexpected expenses can arise at any time. It’s prudent to build a financial cushion into retirement plans to cover unforeseen events, such as home repairs, medical emergencies, or family obligations.

The Role of Financial Advisors in Retirement Planning

Given the complexity of retirement planning, seeking guidance from a qualified financial advisor is highly recommended. Financial advisors can provide personalized advice tailored to individual circumstances, helping individuals:

-

Assess Financial Situation: A financial advisor can thoroughly assess your current financial situation, including income, expenses, assets, and liabilities.

-

Define Retirement Goals: They can help you define your retirement goals, taking into account your lifestyle preferences, desired activities, and legacy aspirations.

-

Develop a Financial Plan: They can develop a comprehensive financial plan that outlines strategies for saving, investing, and managing retirement income.

-

Monitor and Adjust Plan: They can monitor your progress and make adjustments to your plan as needed to account for changes in your circumstances or market conditions.

-

Provide Objective Advice: They can provide objective advice, free from emotional biases, to help you make informed financial decisions.

Alternative Retirement Savings Strategies

Beyond traditional retirement accounts like 401(k)s and IRAs, several alternative strategies can help boost retirement savings:

-

Real Estate Investments: Investing in rental properties can provide a steady stream of income in retirement. However, real estate investments require careful management and come with certain risks.

-

Side Hustles: Engaging in side hustles or freelance work can generate additional income to supplement retirement savings.

-

Downsizing: Downsizing to a smaller home can free up equity that can be used to fund retirement.

-

Delaying Retirement: Working a few extra years can significantly increase retirement savings and reduce the number of years you need to draw on your nest egg.

-

Annuities: Annuities provide a guaranteed stream of income in retirement. However, they can also come with fees and restrictions.

Leveraging Technology in Retirement Planning

While ChatGPT may not be a substitute for a financial advisor, technology can play a valuable role in retirement planning:

-

Budgeting Apps: Budgeting apps can help you track your spending, identify areas where you can save money, and set financial goals.

-

Investment Platforms: Online investment platforms offer access to a wide range of investment options and tools for managing your portfolio.

-

Retirement Calculators: Retirement calculators can help you estimate how much you need to save for retirement based on your current financial situation and retirement goals.

-

Financial Planning Software: Financial planning software can help you create a comprehensive financial plan and track your progress over time.

The Psychological Aspects of Retirement Planning

Retirement planning is not just about numbers; it also involves psychological and emotional considerations:

-

Identity and Purpose: Retirement can be a major life transition, and it’s important to find new sources of identity and purpose.

-

Social Connections: Maintaining social connections is crucial for mental and emotional well-being in retirement.

-

Financial Security: Financial security is essential for peace of mind in retirement.

-

Adaptability: Being adaptable and open to change is important for navigating the challenges and opportunities of retirement.

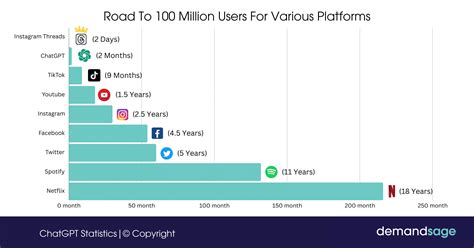

The Future of AI in Financial Planning

While currently, AI tools like ChatGPT should be used with caution and professional oversight, the future holds promise for more sophisticated and personalized AI-driven financial planning solutions. As AI technology advances, it could potentially:

- Provide more accurate and personalized retirement projections.

- Automate investment management and portfolio optimization.

- Offer real-time financial advice based on individual circumstances.

- Detect and prevent financial fraud and scams.

However, it’s crucial to address ethical concerns and ensure that AI-powered financial planning tools are used responsibly and in the best interests of consumers.

Conclusion

ChatGPT’s retirement number serves as a valuable reminder of the substantial savings required for a comfortable retirement. However, it’s crucial to recognize the limitations of AI-generated estimates and the importance of personalized financial planning. Consulting with a qualified financial advisor, carefully assessing individual circumstances, and adopting a proactive approach to saving and investing are essential for achieving a secure and fulfilling retirement. Relying solely on generic AI outputs without considering personal financial nuances can lead to inadequate preparation and potential financial shortfalls during retirement. Therefore, use AI as a tool for initial exploration but always supplement it with professional advice and detailed personal planning.

Frequently Asked Questions (FAQ)

1. How accurate is ChatGPT’s retirement estimate?

ChatGPT’s retirement estimate is a general approximation and should not be considered a definitive financial plan. Its accuracy depends heavily on the assumptions it makes, such as annual spending, investment returns, and inflation rates, which may not accurately reflect individual circumstances. Financial experts recommend using it as a starting point for discussion but emphasizing the need for personalized financial planning with a qualified advisor.

2. What are the key factors that influence retirement savings needs?

Several factors significantly influence retirement savings needs, including:

- Desired Lifestyle: The more luxurious and active your desired retirement lifestyle, the more savings you’ll need.

- Healthcare Costs: Unexpected or ongoing health issues can drastically increase expenses, necessitating a larger retirement fund.

- Inflation: The rate at which the cost of goods and services increases impacts the purchasing power of your savings over time.

- Investment Returns: The performance of your investments significantly affects how quickly your savings grow.

- Retirement Age: Retiring earlier means you’ll need more savings to cover a longer retirement period.

- Location: The cost of living varies significantly between locations, impacting your monthly expenses.

- Taxes: Taxes on retirement income can reduce the amount available for spending.

3. What are some common mistakes people make when planning for retirement?

Common retirement planning mistakes include:

- Starting too late: Delaying saving can make it difficult to accumulate sufficient funds.

- Underestimating expenses: Many people underestimate their healthcare costs and other expenses in retirement.

- Not accounting for inflation: Failing to factor in inflation can lead to savings being depleted faster than anticipated.

- Investing too conservatively or aggressively: An investment strategy should align with risk tolerance and time horizon.

- Withdrawing funds early: Taking money out of retirement accounts before retirement can incur penalties and reduce long-term growth.

- Ignoring taxes: Neglecting tax planning can result in higher tax liabilities.

- Not having a plan: Failing to create a comprehensive retirement plan can lead to inadequate preparation.

4. What steps can I take to improve my retirement savings?

To improve your retirement savings:

- Start saving early and consistently.

- Increase your contribution rate to retirement accounts.

- Take advantage of employer matching contributions.

- Diversify your investment portfolio.

- Reduce expenses and debt.

- Consider working longer.

- Seek professional financial advice.

- Review and adjust your plan regularly.

5. How can a financial advisor help with retirement planning?

A financial advisor can provide personalized guidance tailored to your individual circumstances, helping you:

- Assess your financial situation and retirement goals.

- Develop a comprehensive financial plan.

- Choose appropriate investments based on your risk tolerance and time horizon.

- Manage your retirement income and expenses.

- Minimize taxes and maximize your retirement savings.

- Monitor your progress and make adjustments to your plan as needed.

- Provide objective advice and support throughout your retirement journey.